More and more I seem to be encountering people who aren’t prepared financially.

I’m not talking about being prepared for a TEOTWAWKI event; but rather, being prepared for the personal disasters which happen in our lives; things like a medical emergency, loss of a job or death of a loved one.

I recently attended a symposium on preparing for aging. My wife and I both have aging mothers, as well as no longer being spring chickens ourselves. We went mostly with the idea of getting all the paperwork right for our moms, but also with the idea of getting things right for ourselves too.

The lady who organized the symposium runs a church ministry for the elderly. She herself was unprepared when her husband died, even though they were fairly well off, financially speaking. But even though they had money in the bank, she couldn’t get to it, leaving her temporarily in a bind, until things got straightened out. Like many of us, she didn’t have cash on hand; but was accustomed to using plastic for just about everything.

What made it worse for her is that their budget was based upon both of their retirement incomes, including Social Security. But you can only receive your own or your spouse’s Social Security, in a case where your spouse has passed away. So, not only couldn’t she get to the money they had in the bank but her monthly income dropped as well.

This situation was much more typical than most of us realize. In what turned out to be adding insult to injury, the poor woman didn’t have any idea about their finances, other than who their bank was. Her husband had taken care of everything and she hadn’t bothered to find out. She had to learn quickly.

Follow the Boy Scout Motto

The Boy Scouts have had the same motto ever since their inception. That’s, “Be prepared.” Yes, that’s right, the Scouts were the original preppers, thanks to Robert Baden-Powell, the English soldier who first came up with the idea of the Scouts. When he was asked “Prepared for what?” his response was “Why, for any old thing.” I think he would have fit in just fine with the modern prepping movement.

Today, we tend to spend too much time thinking and talking about the big disasters, the TEOTWAWKI events and forget to talk about the personal disasters that can befall any of us at any time. Yet going through those personal disasters can be just as hard as trying to make it through the biggies.

Granted, that’s what prepping is all about. But if we are not financially prepared, we’re not prepared. I don’t want to spend a lot of time talking about that here, but I do want to mention two of the most important points: get out of debt and have some cash on hand.

Get Out of Debt

The best investment you can make is to get out of debt. Your outstanding loans are always at a much higher interest rate than the interest you can receive on savings. They’re probably higher than anything you can get from a mutual fund as well. Paying off those loans means that you are saving money on that interest each and every month.

Getting out of debt will mean that you have more money available to invest. It will also mean that you don’t have any risk of losing the items which are collateral for the loans. From a prepping point of view, that means you won’t lose things that you need to have.

Have Some Cash on Hand

While cash isn’t the most secure investment there is, it’s fairly secure. There is little chance of it losing a large amount of its value, unless there is a major financial collapse. It does regularly lose small amounts of value, through inflation; but it will do that in the bank too. With today’s low interest rates on savings, you’re not losing much by not having that money in the bank.

What having cash does for you is insure that you have something to work with, if you can’t get to the money you have in the bank. There are a number of possible scenarios which would make that happen. Probably the simplest is anything which interrupts electrical power service. That’s all it takes to make it as if you didn’t have that money.

So, how much cash should you have on hand? I normally say, “The more the merrier,” assuming you have someplace secure to store it. But at a minimum, I’d try to have a month’s worth of expenses on hand. That’s enough to ensure that you can continue operating for at least a month, even if you can’t get to any of your other money.

Best Low-Cost Investments

Now that you have some cash on hand, it’s time to start thinking of investing. What should you do? Stocks? Bonds? Mutual funds?

Food

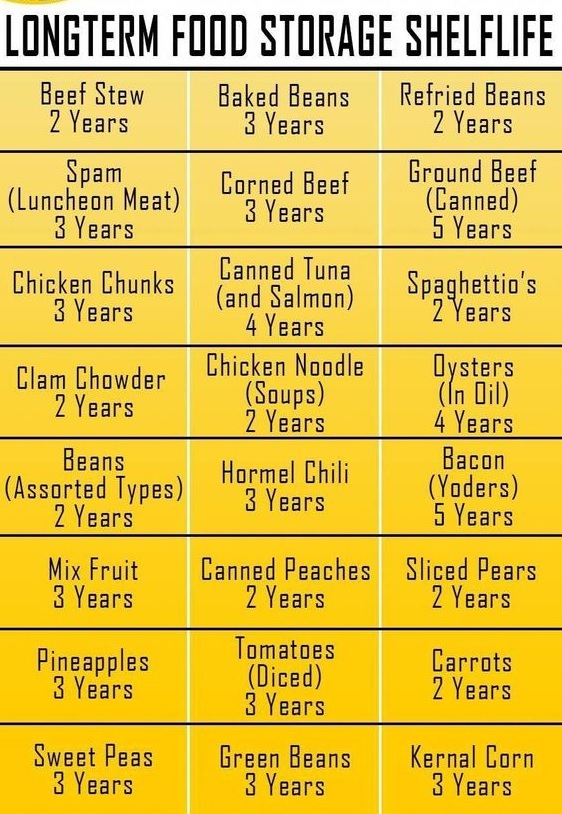

None of the above. The single best investment for people who don’t have a lot of money is food.

I realize that might sound a bit crazy, but hear me out. First of all, food has an annual inflation rate of about eight percent; that’s even with the overall inflation rate hovering between 1% and -1%. Other than medical costs and college educations, food has one of the highest inflation rates there is in our current economy, with an annual average over the last several years of at least 8%, sometimes more.

What that means is that if you invest $1,000 in non-perishable food today, in five years it will be worth $1,469. That’s an increase of 46%. There aren’t too many things which will give you that much of an increase in value, without having to invest a whole lot of money.

Of course, the other good thing about food is that you can always eat it, so your survival stockpile and your investment stockpile can be connected to each other. In fact, the best way of cashing in on this particular investment is to eat the food, setting aside the money you would otherwise spend on it in the grocery store as the “sale” of that investment. You could either reinvest that money in more food or you could do other things with it.

Fuel

The other high inflation item is fuel. But that’s a hard one to invest in, at least in the same way of investing in food. The only fuel source that you can stockpile at home is wood, if you happen to use a wood-burning stove. If so, you might want to consider stockpiling wood.

The problem with stockpiling firewood is that it is bulky and difficult to store. While many people just stack it outside, that’s not ideal; especially if you’re planning on keeping it for a long period of time. Rather, you want to keep it in an open-sided shed, in such a way that the ends of the logs are protected from rain. Otherwise, the logs soak up water, helping to cause them to decompose.

Silver

Many people talk about investing in precious metals as an investment. While they mean gold and silver, most of us think we can’t afford it due to the high price of gold. But silver never has been and never will be as expensive as gold is. You can buy one ounce silver ingots or coins cheap enough, that you might want to consider buying a few every payday.

Believe it or not, silver has historically been a better investment than gold. So, while you might need more silver to build a fortune, your fortune would actually grow faster. When it became time to cash in on that investment, silver is usually easier to sell than gold is, as well.

But that’s not the only advantage of investing in silver. If push came to shove and we had a major financial crash or other disaster where it is necessary to barter for goods and services, silver will be much easier to barter with than gold will. If all you have is gold, then you may end up giving a gold coin in trade for something of much less value, just because you need that item. But if you have silver, you can negotiate for how many coins, saving yourself from overpaying.

Besides, paying in silver will mean that you can barter for cheaper prices. Offering someone 50 silver dollars sounds like a whole lot more than 1 gold piece, weighing one ounce, even though the gold piece is worth more (at the time of writing, one ounce of gold was worth the same as 86 ounces of silver). Generally speaking; people think in terms of 10 to 1 or 20 to 1, not 86 to 1.

Invest in a Business

An even better investment, even though it is riskier, is to invest in a sideline business. Most of us depend on only one income stream to meet our needs. If something happens to that income stream, we are left without any source of income.

With the internet, it’s easier to start a business today, than ever. One can easily start an eBay store, selling to any number of niches. Between buying products from China and selling them on eBay, it is easy to make a good profit, even with selling things cheaper than they can be bought at the local store.

But eBay isn’t the only online option. If you like making things, than Etsy is the platform for you. there is an incredible market for handmade goods of all types. This gives you an opportunity to turn a hobby into a money-maker, perhaps even to the point where it replaces your full-time job.

Another good option is to start a YouTube channel, showing how to do something that you’re an expert at, but others might not know how to do. The top YouTube earner for last year made something like $16 million, $2 million more than the year before. All he is doing is creating videos of himself playing video games, showing other gamers how to beat the games.

Of course, you don’t have to limit yourself to an online business. Many a budding entrepreneur has made their fortune making and selling things locally. I know two different people who made a good business out of baking; one was making amazingly good muffins and the other craft pies. The man making the pies opened a café/store selling his pies and the woman making the muffins sold them through the local supermarket chain. Both made good money and ended up selling their businesses for a substantial profit.

Don’t worry if you don’t make a profit right away in any of these ventures. At the beginning, any new business requires reinvestment of your earnings. It is only when the business becomes stable that you can count on withdrawing profits. Until then, you’re better off reinvesting them in the business, expanding it and making it grow.

A TEOTWAWKI Business

Don’t limit your thinking about businesses to things that are useful today; after all, we’re preppers. There may be some skill you have, which could be considered “artistry” today, but would be extremely useful in a post-disaster world. One such skill would be blacksmithing. Were the grid to go down, that might very well become one of the most important skills there is.

Another thing to consider is repair businesses. Not only do people always need things repaired and have trouble finding anywhere to do it, but repair businesses flourish during times of crisis, especially a financial crisis. When people can’t afford to buy new items or can’t find new items to buy, they return to their old ones, trying to get more mileage out of them. That often means repairing them.

I know a man who goes dumpster diving at night, driving by and looking at people’s trash, in search of things that might be repairable. In a couple of hours on the average evening, he finds enough to fill the bed of his (small) pickup truck. Taking those items back to his shop, he repairs them and sells them.

Often, he finds multiple similar items, with one part of the item that has failed. He is then able to take parts from each and put them together, making a good unit out of two or three. A fan he sells might have a body and blade which came from one fan, a motor that came from a second and a switch that came from a third. All he’s got invested in it is the time it took him to put them together.

A Quick Wrap-up

In order to invest effectively, even with limited funds, the key is to find something that is going to increase in value. Whether that value comes from time or sweat equity, it’s still going up in value. That’s where your profits come from. In a sense, you’re investing in yourself and your ability to see what others need. So what do you see, which you know that others need?

Pingback:4+ Smart Ways To Invest Even If You’re Low On Cash – Prepping | December 3, 2019

|

Pingback:4+ Smart Ways To Invest Even If You’re Low On Cash - Survival Gear Review | December 3, 2019

|

Pingback:4+ Smart Ways To Invest Even If You're Low On Cash | Survivopedia - Million Views of Survival - Wilderness Fishing, Huntings. Catch and Cook, Smoke and Eat Wilderness Fishing Top Stories and Tricks | December 3, 2019

|

Pingback:4+ Smart Ways To Invest Even If You’re Low On Cash – Welcome to Survival Pal | December 3, 2019

|

Pingback:4+ Maneiras Inteligentes De Investir, Mesmo Se Você Estiver Com Pouco Dinheiro – Brasil No Caos | December 3, 2019

|

Pingback:4+ Smart Ways To Invest Even If You’re Low On Cash - Survival Blog | December 3, 2019

|