For the last several years, the official inflation rate has been hovering around one percent or less. But that’s come to an end.

As of now, the inflation rate for this year is set to increase by 4.2%. That’s much lower than back in 1980, but the highest we’ve seen in over a decade.

I say “official inflation rate” because anyone can see that some things have gone up more than that, especially food. But the official government number comes from the Consumer Price Index (CPI), a list of everyday consumer items which are supposed to give an accurate picture of how the overall cost of purchasing products is rising and falling.

Of course, individual items go down, covering up for others that are going up. Electronics, for instance, tend to go down, which makes up for food prices going up. So the CPI isn’t a perfect picture of the economy or what it costs to live. All it is is a number we can use in comparing one time to another, and right now, it shows that we’re entering into a time of high interest.

This is concerning for several reasons, including that runaway interest is one of the critical signs of an economic collapse. While the interest rates we see right now are nowhere near as high as we can expect to see in a time of an economic collapse, they’re heading in that direction.

Considering that so many financial gurus have been talking about a pending collapse, rising inflation is concerning. But, on the other hand, it could be a sign of things to come.

Another troubling indicator is that unemployment is rising at the same time as inflation. President Biden’s approach to the economy doesn’t seem to be instilling confidence in either consumers or employers, and the new job creation is only about one-fourth of what it should be.

But that’s not my focus right now. Long before we reach the point of an actual financial collapse, we’re going to have to deal with rising inflation.

Having lived through that before, I’ve experienced what the rise in prices does to one’s buying power, making it so that the money we do have doesn’t go as far. So if we expect to maintain the lifestyle that we have now, we’re all going to have to make some changes.

Where’s the Inflation Coming From?

I’ve been expecting inflation to rise for about a year now. There’s a myth that’s taught in just about any school that teaches anything about economics. That myth is that inflation comes from greedy businesses raising prices. But that’s not true. If companies raise prices, they lose customers, so that’s not a good deal for them. Most will try to avoid raising prices until they are all but forced to do so.

Where inflation comes from is the government, specifically the Federal Reserve. Now, I know that the Fed is technically independent from the government. But the reality is that the two work hand-in-hand. For example, much of our nation’s debt is in the hands of the Fed, which issues money to meet the government’s needs, holding a mortgage on that money.

Usually, this is done through what is known as “quantitative easing,” something that our Federal Reserve has practiced for years. They issue X billions of dollars of new money per day, creating it out of thin air to “ease” the “pressure on the money pool. But since the actual value of that money is based upon our country’s GNP, if they issue cash faster than the GNP grows, they’re diluting the value of the existing money, making it worth less. That’s inflation.

:max_bytes(150000):strip_icc()/inflation_FINAL-5c8975c946e0fb0001a0bf75.png)

On top of this, Congress has authorized something north of five trillion dollars in COVID-19 spending through a series of massive bills. They aren’t done spending money either, as Biden’s “infrastructure bill,” which doesn’t have much to do with infrastructure, is about to hit, with a price tag of somewhere close to another two trillion dollars.

The Fed will gladly buy up that debt, just like they did the COVID debt, lowering the value of our money just a little bit more. Put another way, Congress is spending us into inflation, and the Federal Reserve is helping them do so.

Loans and Mortgages

With that being the case, allow me to start by talking about loans, specifically mortgages. Interest rates are already climbing. I just bought a house, and in the month between my loan application for the first home, a deal that fell through, and the loan application for the home we ended up buying, the interest rate went up a full percent. That’s even with my credit rating going up 30 points during the same period.

To put a point on it, that one percent increase in interest rate has increased my monthly mortgage payment by about $100. So over the 30 years of the loan, I’ll have paid an extra $36,000 for that home, thanks to that one percent.

The chances are that interest rats If you’re thinking about buying a home, you’d better do it now, before things get worse. For that matter, the same advice goes for anything else you might be considering buying on credit. Right now, waiting a year might allow interest rates to price that purchase right out of your budget.

If you’ve got a reasonable interest rate on something now, whether it is a home or a car, then I wouldn’t be in a hurry to trade it in for something newer, even if that newer home or car is bigger and better. So what you’ll lose in extra interest is going to mean that your money just isn’t going to be able to go as far.

Living on Less

The big problem we can all expect over the next few years until inflation drops again is that it’s going to be harder to pay for everything. That may not affect some people, but 63% of Americans live from paycheck to paycheck. Those people are suddenly going to find that they don’t have the money to do everything they were doing before. And with an inflation rate of over 4%, that’s not going to take long.

Just because costs are going up, that doesn’t mean that companies will provide raises to match. While many companies include a cost of living increase in their employees’ annual raise, it rarely meets the actual increase in cost. Instead, it’s a theoretical figure, which may have little to do with reality. Typically, the higher the inflation rate, the more disparency there is between the actual inflation rate and the cost of living increase that companies offer.

But what if inflation goes up even faster than what we’re currently experiencing. With Congress on a spending spree, there’s no telling what’s the following trillion-dollar-plus packages they’re going to pass, adding to the national debt and increasing inflation all that much more. But with the “reset” going on and the new ideas about economics being touted, there’s nothing to stop them.

That means that the self-appointed elites will still be elites while working hard to push us all down into peasant status. If they had their way, we’d all be on the government dole so that they could control us all that much better. To beat them, we’re going to have to learn to live on less.

Do It Yourself

One of the best means I’ve found to make my money go farther is to do things myself, rather than paying someone else to do them. From replacing an engine in my car to cooking my meals, I do everything I can for myself rather than buying prepared ones.

A lot of this is centered around my home and my prepping. I don’t buy packaged survival food; I package my own. Nor do I pay someone else to drill my well. While there are still costs associated with doing things myself, it’s ultimately cheaper to do just about anything myself, especially if I have to do that thing more than once.

My house doesn’t have a two-car garage, but rather a workshop. I’ve got a pretty good collection of tools that I’ve bought over the years, allowing me to make or repair many things. Right now, I’m working on building an antique-style coffee table and some matching end tables. Were I to buy them, it would easily cost over $2,000. But by making them, I’m saving about 85%.

This requires investing in tools, but I’ve always found an investment in tools to pay off. I don’t just buy those tools to buy tools, but rather, I buy them when I have a significant project I’ll need them for. That project pays for the tool and every time I use it afterward saves me money.

Reevaluate Your Budget

Budgets tend to get away from us. First, we start with the best intentions; then, we find that our spending has gotten out of control over time. Sometimes it’s that we’re spending more than what we had budgeted for. Still, more often than not, it’s spending that we never included in the budget, especially things like monthly subscription services, which don’t seem all that expensive but add up to be a bunch of money every month.

With costs on the rise, you’re likely to find that you’re spending more than you anticipated on some budget items. For example, my wife and I just reevaluated what we’re spending on food, finding that we’re spending almost double what we had budgeted. Fortunately for us, our finances have enough slack in them to make up for the difference; but that might not be the case for everyone.

Another thing that can kill your budgeting attempts is eating out frequently. Our budget for that is relatively low, with us eating out two meals a week. But with preparing for a move, we found that we’re spending more on eating out than we’ve budgeted for. I mention this because such items easily slip into the monthly expenditures, destroying our budget.

With costs going up and money becoming tighter, there is less room in anyone’s budget for spending errors of this sort. So instead, we must be more cautious than ever to ensure that what we are spending is what we’re expecting to spend.

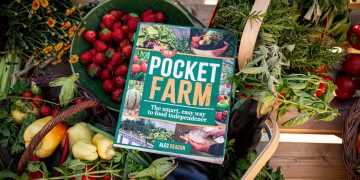

Find a Cheaper Way

All in all, the best thing any of us can do is find less costly ways to live. This might mean some profound lifestyle changes, but the changes will be small for most of us. For example, growing a vegetable garden and canning your food isn’t a significant lifestyle change, but it can go a long way towards lowering food costs. Likewise, baking bread in a bread-maker or baking your cookies can help save on the family budget without making considerable changes to your life.

But some things should be looked at which might force some change. For example, one of the significant expenses for many families is paying two-car payments. For some families, that works out to be just as much as making their house payment.

I never allow myself to be saddled with two car payments at the same time. Instead, I buy one newer car for my wife to drive, and I drive an old one. Hers is the family car. That way, I’m sure that she’s driving something reliable. If something happens to mine, I’m probably going to be able to take care of it on the road. Even if not, I can have a buddy help me tow it back home to fix it.

Another thing to avoid is those monthly subscription services. There’s a real temptation to have them today, to have access to everything we want. But do you need five television streaming services? Can you justify that as part of your expenses? Will you still be able to explain it when things get tight?

A Final Thought

While things aren’t bad right now, there’s every indication that they’re going to get worse. That’s why I wrote this article. I’m hoping to encourage you to take action now so that you won’t have problems later. That’s what I’m trying to do.

If you wait for things to get worse, then it’s going to be much harder to make these changes. You’ll be locked into what you’ve got, even if you can’t afford it. That’s how people end up losing their homes and declaring bankruptcy. I’m sure you don’t want to be one of those in that situation.

You touched on something in the “coping with it” part of your article. You eat out less,. You keep your older car. You stay in your present house. You do it yourself. All of these things translate into an economic slowdown death spiral. You’re not buying as much, so businesses aren’t selling as much. Businesses start laying off. Rinse, repeat. Inflation is a dragon that eats its own tail, and we get to bear the pain.

Minimize your exposure to debt! Do you REALLY need that new “whatever?” Credit cards are evil, plain and simple. Most of us can’t get around financing a car or house, but the rest of it, for the most part, is fluff. Don’t spend what you don’t have! Pay down your debt as QUICKLY AS POSSIBLE! Re-use. Repurpose. Rethink!

Buy tomorrow with today’s dollars! If you use canned vegetables, and they come up on sale, buy as much as you’ll use before they go bad. ‘Same goes for things like coffee and frozen foods. For the frozen stuff, buy a vacuum sealer! You can buy in bulk and portion it out. That way you don’t cook up more than you need, and what’s in the freezer will last a LONG time. I also use that thing for things like pasta. Vacuum seal two or three boxes of spaghetti, linguini, or the like in a bag, and it’ll last FOREVER! Make the bags long enough that when you remove one of the boxes, you can reseal the other two.

We’re preppers, folks. We make a life of seeing the headlamps of oncoming trains. …Some trains just move slower than others… until they hit a downgrade…

Great Ideas and reads, but in my 50 yrs of life, I have learned that they only true way to out pace inflation is to increase cash flow (not to be confused with income) at a higher rate then that of which inflation is growing. While part of this does fall into the budgeting – the average working person is already living check to check and when it is taken away (like over the last year) they can be found on the wrong end of rope. A person has to learn to invest in income producing assets. While many will turn to stocks, bonds and crypto – they do not produce any real income – but rater protect the current value of said money. To better understand – if you bought 1 ounce of gold today for $1700, you still have just an ounce of gold, sure the value of it can up or down, but in reality it is still just an oz of gold, same applies to crypto, while some stocks and bongs pay a small dividend – do you really want to keep buying at all time highs? In order to realy beat the race, one has to use an asset to produce more income – like some real estate, classic cars or better yet some sort of business. With a business, you also are able to take advantage of extra tax deductions that are not offered to those who just work a job. So what is the best business? When that depends on you really – but to start off, you want a home based business, this will allow a person to tax deduct a part of the bills that the are currently paying and help keep more of your money by reducing the amount of taxes your pay. Use that savings 3 ways – 1 emergency savings, 2 pay down curent debt and 3 put back into your business to grow it.

A very-very timely article ! Also a much needed wake-up call. Most of this Countries citizens are living beyond their means through credit card debt. It is estimated that 40% of our population has a credit card debt of between 10,000, to 20,000 dollars.

Americans of the last tw0 generations have grown up with the idea that credit is a good thing. To a point, credit allows important items, such as cars and homes to be purchased, that long time saving for is just not practical to do. As interest rates paid on CD’s, and most savings accounts are way-way below the inflation rate. To add to that lack of interest, your then taxed on that interest your savings gained as well. One the other hand, credit card interest is about the highest loan interest rate you can become involved with. Other than what a loan Shark would charge.

Take a home mortgage for example. Over the life of say a 30 year mortgage, the interest you pay on that loan alone, not only buys your home, but also pays the mortgage company the equivalent of another home of equal value !

There is the old adage that you can write off the interest you pay on your taxes. You can write off a percentage of that interest, but there is no getting around the fact that you still have to pay that interest one way or another. It doesn’t magically disappear in the shell game.

People today have the illusion that if you have a boat, a nice home or car, that they own them. In reality, they own usually 10 or 20% of whatever was purchased that they put down as a down payment. The other 80 or 90% of that item belongs to the credit or loan company. Not the purchaser.

If you sell the item, rest assured that the loan holder will want the rest of the loans value beyond what you have paid off in the principal. You might look upon credit interest as a “use tax”. Or kind of like “leasing the item”. It isn’t yours until it is paid off, And you will usually find that when you have, you also paid enough interest to have bought two of the items.

Credit interest is a necessary part of an economy, if not abused. Or its being allowed to raise to a level that it controls your life by being such a debt load that you can not afford to retire, or move to another area better suited to your present life style.

Inflation is an insidious thing. Prices may increase, and offer an illusion that something is increasing in value, when it is not. The price increase in most cases is simply compensating for the value of that money dropping in purchasing power. There are several good inflation calculators on internet. It is VERY interesting to see how behind the scenes, you may think you home is gaining in value, and yet in reality it is simply keeping up with the inflation.

Inflation is counterfeit money. Money that isn’t worth its value, Only the government benefits from inflation. The citizens make up the loss in value by the deprecation of their savings, and the increased cost of the item. Then when you add in the credit interest you pay, and the illusion suddenly has a new look.. In December, 38% of all households, 90 million nationwide, reported difficulty paying for usual expenses. And 9 1/2 % of US adults faced housing insecurity in December. Depending on the organization surveyed, the US now ranks between 13th and 15th in the worlds standard of living.

There is nothing like owning, free and clear, your home and car. You may have to forgo many temptations to keep debt to a minimum. But in the end you will be freer in your life’s choices, and sleep better knowing you can survive being laid off from work for a reasonable period. Or being able to retire when you feel like it.

There is no secret to financial freedom. It is simply disciplining your needs, to your ability to minimize credit interest. While saving for future needs in inflation proof investments. If so, in the end, as you look across the street at the Jone’s house. At their new car. The 21′ boat in the driveway. The landscaper mowing their yard. A voice in you will likely say, “Yeah, they may appear to have the good life, but the odds are more than likely that their lifestyle is all an illusion founded on credit. While yours is not. You truly own what you have. And if needed, what you own has a true value that can be cashed in if needed. And you can look forward to retiring in a life style, other than living as a homeless person if the economy crashes. You will begin to see, that your true freedom of choice is determined by you, and you alone.. Not by others.