We definitely live in interesting times, and this may be a curse or a blessing, depending on whom you ask.

For the first time in history, the markets now expect the FED Funds rate to be negative[1]. As in, the markets are actually factoring in negative interest rates for 2021. So, we’re not talking about zero interest rate policy, as right now, FED Funds is targeted between 0 and 0.25, but according to forwarding contracts, the implied FED Funds rate in the first quarter of 2021 is a negative number. This has never happened before.

If you come to think about it, the markets are thinking that the Fed Funds rate is going negative in January or February of 2021, and this means we’ll be in an economic recession next year. If the markets anticipated that the US economy was doing well, why would they factor in negative interest rates, right? We know, this may sound a little bit esoteric for some of our readers, but these are the facts.

Speaking of facts and today’s topic, which is the incoming economic crisis, back in February, Larry Kudlow, Trump’s economic adviser, claimed[2] that the damage inflicted by the SARS-Covid19 pandemic would be minimal, and obviously he was talking about the impact on the US economy. Based on Kudlow’s prediction as well as many others, including so-called virologists like Fauci and/or Bill Gates type “experts”, who all projected US deaths from Covid19 to be in the millions, President Trump and his team decided to basically shut down the US economy to fight the pandemic.

Fast forward to today, and we already have some dismal hard data: more than 26 million people were added to unemployment rolls, the GDP is in free fall, millions of small businesses are on the verge of collapse and desperate for the government to bail them out, the supply chain is reaching its breaking point as manufacturing is in freefall, unemployment is officially at 19% soon to reach depression-era levels, and so on and so forth. It would be safe for us to assume that all the experts were amazingly (not surprisingly) wrong, including Kudlow who now sounds like a moron, not to mention the failed[3] computer-models that claimed 2,2 million Americans will die of Covid19.

If you take a Gestalt look, it becomes obvious that the US economy, which in theory is a free market economy that follows the basic rules of supply and demand, is now interdependent with many nations, including China, to which is tightly connected. This is actually one of the biggest dangers of globalism economically speaking, as it forces once sovereign nations to lose their redundancies which would otherwise protect them from economic collapse. The thing is, since China is America (and Europe’s) industrial park if anything goes down in China, or another major economy by that matter, this event will bring down all other economies in a domino effect.

Another big problem with the US economy is the Everything Bubble, as our country’s financial structure is built on sand, and by that, we mean record levels of personal/corporate/national debt, plus a serious decline in manufacturing and demand. The FED-created the Everything Bubble via 10 years of stimulus measures and fiat money in order to keep the system afloat, yet it’s pretty clear now that the bubble is going to collapse sooner rather than later. With FED’s repo markets already on the verge of collapse, the Covid19 situation may be the final straw to break the camel’s back so to speak. Speaking of which, if you take a look at how “authorities” reacted to something very similar to the regular flu in terms of mortality (for further information on this, watch this video), we can expect further “waves” of infection in the autumn/winter when respiratory illnesses are prone to re-appear as they do every year, followed by wave after wave of “lockdowns”, i.e. the US economy is going further and further down the drain.

Why is this happening? Well, it looks like our benevolent “overlords” have already decided that the “new global order” will be led by China, not the US. In my view, the recent situation with oil being traded as a negative dollar price was a monetary event, not a market event, and it signifies the end of the Bretton Woods system, aka the end of the petrodollar. Whether you acquiesce to this theory or not, you should take the looming economic crisis very seriously, and consider this: unlike the US and Europe, China did not close its economy following the pandemic. They only closed Wuhan down, as in they basically quarantined an entire city, but not the whole country, and there were no lockdown orders in place not even in Wuhan, only social distancing stuff, mask-wearing was made compulsory, sick people were forced to stay indoors and things of that nature. And today, China’s economy is up and running, unlike ours.

What does it mean long-term? The worst-case scenario is that we will be faced with an economic crisis or even an economic collapse, and here’s what you should prepare for. First, don’t expect a global economic collapse, as not all countries are in the same situation. So, yeah, you could consider relocating to another country before SHTF, and by that, I mean places with a sound monetary policy and solid economies. Think along the lines of Switzerland, Japan, South Korea, Denmark, Norway, Australia, New Zealand, to name just a few. If you twist my hand hard enough, I may write an article in the future on this topic.

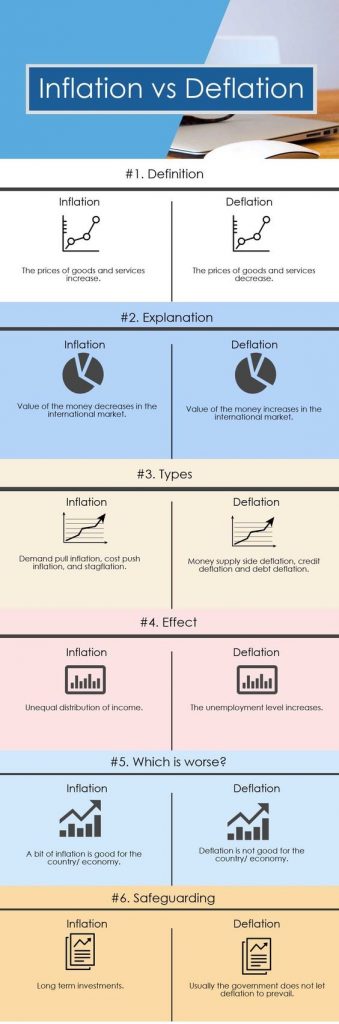

But what will happen to those of us who choose to face the music at home? The most probable scenario for the US during economic collapse is hyperinflation, which is a completely man-made disaster due to governments/central banks printing money like there’s no tomorrow. Hint: FED’s QE 1, 2, infinity, plus fractional reserve banking. This money printing creates a chain reaction long-term, and as people lose faith in the US dollar, the currency loses value, people start perceiving money as worthless, and hoarding valuable items begins. Price controls are the next step, as the federal government tries to stop hyperinflation by any means necessary, but the supply/demand rule will cause prices to skyrocket regardless. Soon enough, you will not be able to find anything in stores, and yes, this situation already occurred in countries like Venezuela (it’s in motion right now), Zimbabwe, and Yugoslavia in the 90s’ among others.

Without enough food/essential supplies on the shelves, people get creative or starve. Those with relatives living in the country may do better than others, but city dwellers will essentially end up starving, especially if the supply chain breaks (read my article on that issue).

Looting and fighting for resources may become the new normal in hyper-densely populated cities like LA, New York, etc., while people living in “flyover America” i.e. farmers and country folk capable of self-sustaining via agriculture/barter economy will get over an economic collapse with relative ease. Under hyperinflation, money no longer works[4], so living through an economic collapse means you must be able to survive without money.

As I learned from Venezuela’s experience, even if keeping your job short term may be wise, you’d be stupid to go to work as the paycheck becomes virtually worthless. If you’re already a homesteader, you know you can make more money without actually working a full-time job. Regular people need money for gas, car maintenance, clothes, and takeout meals, which are all essential if you want to keep a 9 to 5 job. If you cut these work-related expenses, you’ll be able to live with less and do things like growing your own food (provided you don’t live in the city), engaging in barter with your local community, and so on and so forth.

Preparing for a financial crisis is all about generating options and reducing your vulnerability, and you should start by repositioning your assets/expenses. By that, we don’t mean only physical assets, but human ones also. What does it mean? Well, skills are essential for survival, and if your current job has already disappeared due to the government imposed lockdown, thus your current way of earning an income is going extinct due to pandemics or whatever, start learning new ways to earn a living, and by that we mean “essential” skills. Be flexible and forget about your pride, start downsizing and if possible, try to go debt-free. Move into a smaller house, pay less rent, buy a cheap car to do your thing, have an austerity plan and, if the dollar falls, prepare to live in a barter economy.

What does it mean? If the money loses value, people will live by trading tangible assets, and yes, that includes skills. A lot of modern jobs will disappear, along with paper money, and everything will revolve around the essentials: food, water, and shelter, plus durable goods like knives, axes, cars (as long there’s fuel available), etc.

Bottom line: try to reduce your debt. If you’re in debt, as in you have credit card/car/mortgage payments each month, your creditors are in control and if you lose your job you’ll lose everything. If you don’t have debt, you only have to worry about losing your job, i.e. you can whether a financial crisis more easily. Next, learn to live without using credit cards, and if you think that’s impossible, talk to your grandparents, or people who paid cash for everything, including houses and cars.

To achieve that, they made sacrifices, as they didn’t buy a new car every 3 years on credit, they lived in a small house compared to today’s standards, etc. but they also were debt-free. Living credit free is basically simplifying your life, as in living in a smaller house, living without a car, renting instead of owning a house (forget about mortgage payments, repairs, maintenance, property taxes, etc.), eating at home instead of eating out, less stress, more time to learn new skills, and that translates into less debt to worry about.

While reducing your expenses, you must also start working on Plan B (alternative income sources), and ask yourself what will you do if your hours at work are reduced or you lose your current job? You can consider starting your own home-based business if you have a hobby, and turn it into your second source of income (read my previous article on that issue). Ideally speaking, you should have an emergency fund to last you for at least six months, but that’s a very tough proposition in this economy. You can start doing it now and contribute an amount each and every month. If you have money in your bank account, it would be wise to cash out and keep the money at home. Banks always have liquidity problems when SHTF and this may lead to you losing access to your money.

Speaking of cash, if you have assets like cars or real estate, you should sell them before the crisis hits. Afterward, as the prices have fallen, it will be hard to find buyers easily.

Moreover, stock at least a three months’ supply of food. Speaking of our highly industrialized and urbanized American/Western populace, its Achilles’ heel in terms of surviving an economic collapse is food. Most people have less than one week’s supply of food in their homes, if that much, at any given moment. You should learn that the average person requires between 2000 to 3000 calories each and every day for maintaining enough energy to function properly, and even more in stressful environments. You can start prepping with 2000 calories/day/person and profit while bulk food is still cheap and readily available. For example, nutrient-dense foods with long shelve lives, such as rice or beans can be bought for less than ~$15 for a bag of 20 pounds. You can supplement with emergency rations, canned meats and veggies, honey, and freeze-dried foods, and you can bet you’ll live better than 90% of the population when SHTF.

Just like with the food supply and other utilities (power and gas for example), don’t put your faith in the public city water system to remain functional in a social collapse scenario. Utilities will be unreliable and sporadic at best during harsh economic conditions, if not totally wiped out. You’ll have to focus on harvesting water from unclean/unreliable sources, you’ll have to learn how to collect rainwater, etc. so consider investing in a high-quality water filter. Also, buy a solar kit; if you’re asking yourself why just go on and try living for a couple of weeks without electricity and you’ll understand what I’m talking about. Life will be dismal without electricity and you’ll have to hedge against this probability as well as you can. A small solar kit able to power up your essential appliances consists of 2x 100-watt panels, a charge controller, a power inverter, and 4-6 12 Volt batteries (deep cycle to last longer) and it will cost you less than one thousand bucks. If you think that’s too much, well, don’t do it, but you may regret it later.

Finally, get in touch with a friend or a neighbor; the key to long term survival is community. Approach a friend who shares your prepping ideas or a neighbor; lone wolf type operations may be practical now and then, but in the long run, everyone needs somebody to watch his back. Don’t fool yourself; you’re not capable to take care of everything on your own.

With all these in mind, stay strong, stay safe, pray for the lockdown to end quickly, and don’t forget to write us in the comment section.

Resources

[1] https://www.reuters.com/article/usa-fed-rates-futures/fed-funds-futures-begin-pricing-in-slightly-negative-fed-funds-rate-in-2021-idUSL1N2CP1DF

[2] https://www.marketwatch.com/story/coronavirus-to-delay-export-boom-from-china-trade-deal-larry-kudlow-says-2020-02-04

[3] https://www.businessinsider.com/elon-musk-prof-neil-ferguson-resigned-moron-absurdly-fake-science-2020-5

[4] https://www.washingtonpost.com/news/democracy-post/wp/2018/01/17/in-venezuela-money-has-stopped-working/?noredirect=on&utm_term=.3a9c28508e85

Your telling everyone how worthless money could be, might be then telling them to sell

actual assets like land and ?? get into money/cash positions.

I was thinking the same thing, Horse. Sell your physical assets for paper that will be worthless???

@Todd and Horse I can’t speak for Chris but what I think he was trying to say was that if you have hard assets like cars, jewels (other than gold and silver) and REAL ESTATE ( he said real estate, not land. there is a difference. I would hang onto land if you can) and you are still making payments on it sell those liabilities. As for the car, selling it would depend in whether or not you’re planning to bug out or bug in. Maybe an even better strategy, if you are reasonably certain that a depression is inevitable, is to sell all those assets that will become liabilities during a depression while cash is still legal tender. If you are able, trade the cash for gold. If a really bad depression does happen then it’s a given that cash on hand will be more than useless. Stock up on barter items. We’ve all talked about this ad nauseum on this and its sister site. During a depression gold won’t be all that useful. You can’t eat gold. But it will once again become useful AFTER the depression ends. And at some point it WILL end. Another thing to consider is that if a depression does happen along with its attendant cousin hyperinflation the government may decide to scrap the federal reserve note you’re now using in favour of a “new” currency; perhaps only giving you 10 cents on the dollar for your “old” money. So no, don’t hang onto your cash if you think a depression is just around the corner. If you have extra in the bank that you don’t need start withdrawing it now. Trade it in for more useful items while the getting is still good. Hope for the best be prepared for the worst. Be smart about things and always look ahead. Take nothing for granted. Especially what the government says.

Excellent article. It’ll pass (eventually – if doesn’t lead to a WW…) but the toll will be huge, in all aspects including human lives, yes. I’d say buy some physical gold if you already own a house (or not), no debts and some extra money (invested or not). Yes it’s smart to stay liquid to have mobility. So keep some cash, a few months worth of basic expenses and some plus for emergencies. That never fails even when money loses value, it doesn’t go worthless overnight, unless of course we go straight back to bartering economy which is unlikely because wel, that means we’ve gone Mad Max or worse indeed. But really, SUVs, fancy phones and luxury purses and stuff like that, those aren’t assets. An unpaid or mortgaged house (sometimes twice) isn’t an asset.. Those are liabilities, just like anything that’s financed. Its smoke. No, actually it’s worse than smoke: all that stuff will soon become a load, a burden to most people and lots of families: think debits, insurance, maintenance, devaluation, recovering, etc. Picture the masses selling stuff, from art to family silver or clothing, cars and well, everything to pay debts or buy essentials (food, shelter, warmth) during the 1929 depression. Mostly middle class for sure, but lots of rich people too, it’s that broad and sweeping. This time it won’t be the stock market but the biblical levels of credit card debt, multiple loans and mortgages, lack of savings and absence of hard (real) assets that either allow you to live /survive on (e.g. a home/farm, etc) or have an income / saving (a skill, tools, a power system), or keep your purchasing power during the peak of a crises like this (gold, safe investments). Keep safe and smart everyone, hope to see everyone on the other side of this mess.

You said:

“China did not close its economy following the pandemic. They only closed Wuhan down, as in they basically quarantined an entire city, but not the whole country, and there were no lockdown orders in place not even in Wuhan, only social distancing stuff, mask-wearing was made compulsory, sick people were forced to stay indoors and things of that nature. And today, China’s economy is up and running, unlike ours. ”

This is false.

On Chinese New Year Eve… The biggest and most important holiday in China, the entire country went DEFCON ONE. Everything was shut down, closed and locked up. And today, the entire nation is still under DEFCON ONE. All the nuclear missiles are armed, and the military is everywhere.

What does this mean?

Well, suddenly all television shows, cell phones, and appliances suddenly had a blue screen with instructions. Everyone was ordered to stay where they were. Military was called to base, all medical and police and fire were ordered to station. And all militia, all the many, many levels of militia were told to don their militia vests, grab their weapons and set up roadblocks. In my complex, I had roadblocks at my house, then at the complex, and then at the town sub-region, and then around the entire town. Every road had multiple layers of roadblocks.

Strict quarantine was enforced by thermo-drones, and robots with megaphones.

Hard lock down was for three weeks. Followed by regional lockdowns permitting limited travel with wechat GPS monitoring.

The nations is still under a monitored and structured lockdown. We are all permitted freedom of movement, but you do need to make sure that no one is ill. Any question and you go to a holding area.

It’s not that I want to distract from your great article, but there are so many crazy ideas about China that are simply not true. Right now, China is the safest place on the planet. And that is a fact, Jack. You can go ahead and think that this is all just another ploy to take Americans freedoms away. Whatever. But we all owe it to ourselves to look at things as they really are. And not what we think or want to think they are.

I’m going to throw out an alternative scenario for debate…Credit card debt will be noncollectable , if things truly fall apart why not max out every card you have and buy the things you are going to need for the multi year dysfunction we are headed for? farmers were able to pay off their mortgages with a carton of eggs during Germany’s inflationary collapse ; $50,000 worth of debt might be paid off with a days paycheck while the food , solar system , tools etc ..you will have in hand . What wage can be garnished if there is no paycheck ?