If you’re anything like me, retirement is just around the corner, sneaking up on you. We’ve tried to put it off and pretend that it isn’t there, and everything is going to be just fine once we retire.

Some of us might even have some idealistic dreams about having time for travel or for our hobbies once we retire, but there’s always something missing from those dreams. That something is the money to fulfill them.

Can we be honest for a moment? Most of us really aren’t at all ready for retirement. We’ve ignored all the advice from the investment and retirement gurus and don’t have the million dollars of savings that we’re supposed to have in order to retire.

We’re lucky if we have a few thousand dollars stashed away for a rainy day. Worse than that, we’re in debt up to our eyeballs, after decades of living on 110% of our income.

Let’s look at some of the ways you can help your budget survive retirement!

The only retirement plan that many of us have is Social Security, which as we all know, isn’t really all that secure. Besides, Social Security doesn’t pay much. If we have any company retirement at all, it’s minimal, because we’ve moved from company to company, throughout our careers, and our retirement account didn’t move with us.

With those sorts of prospects, retirement really doesn’t look all that good. Oh, we’ll have a lot of free time on our hands, but we won’t have the money to do anything with it. In fact, our biggest concern will be making it from one month to the next; not what to do with our spare time.

This is a whole new form of survival, and it’s going to take a whole new sort of strategy to overcome. While it’s really too late to start “saving for retirement” now, regardless of what financial planners might tell us, it’s not too late to make sure we can have a great retirement. We just need to take advantage of the years we have left for retirement, to set us up for life.

Get Out of Debt

The first and single most important thing to do, in order to prepare for a satisfying retirement, is to get out of debt. Most of us are so accustomed to debt, that it’s nothing more than part of the landscape. Yet that debt is sucking the lifeblood out of our finances. Making those monthly payments is controlling what we do and as we retire it will do so even more.

There are a lot of strategies for getting out of debt, so I’m not going to take the time right now to enumerate them. But there are a couple of key things that you should consider doing:

Downsize

Many couples downsize once their kids grow up and move out of the family home. This is a great opportunity to cash in on the equity you have on your home and use it to buy something that you can own free and clear. A smaller house, without a mortgage, will save you in more ways than just the house payment.

Stop Buying New Cars

One of the most insidious parts of the normal family’s debt comes from the idea that we have to have new cars. The saying is, “you either pay it in payments or you pay it in repairs.” But if you maintain a car properly, there’s no way you’re going to pay as much in repairs, as you pay in car payments. Besides, you won’t need that expensive, full-coverage insurance for the car either.

Use Windfalls to Pay Off Debt

Everyone loves getting a cash windfall. It doesn’t matter if it’s winning the lottery or getting an income tax return, we just can’t wait to get our hands on it and spend it. But that money is much better used by paying off debt, so that you don’t have to make all those monthly payments.

My wife and I have used the windfalls we’ve received over the last several years to invest in gold and silver. While we haven’t been able to buy much at once, we have been able to increase our investment. We’re waiting for the day when the price of gold and silver rise enough that we can sell that off and use the proceeds to pay off our mortgage.

Become Self-Sufficient

My wife and I bought our home rather late in life. That means we haven’t been paying on it for the 30+ years we’ve been married, and we’re not close to having it paid off. We knew that when we bought it, just as we knew that buying as big a home as we were buying was going to stretch our finances, especially in retirement.

As I already mentioned, we have a plan for paying off the mortgage. But we also have plans for reducing our monthly costs, so that we can afford to keep living in this home, even in retirement. Those plans include:

Reducing Our Energy Consumption

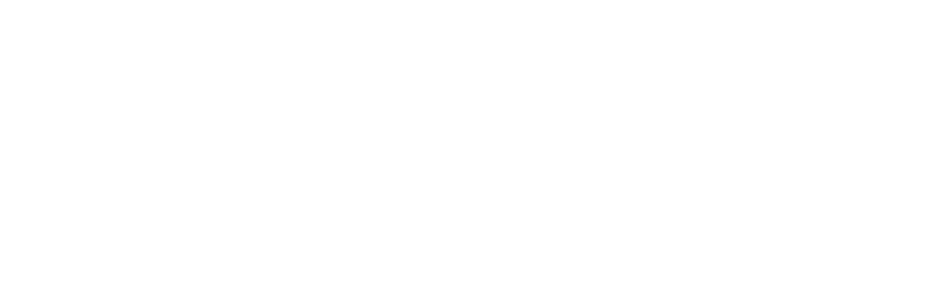

I’ve done a number of projects around the home to reduce our energy consumption. These include reinsulating the attic, adding a plastic film over the windows to make them essentially three-pane windows, zoning out heating and cooling so that we don’t have to heat parts of the home we’re not using, and planting trees and vines to shade our home and reduce the amount of heat generated by the sun. We’ve even changed our roof to a lighter color, so that it wouldn’t absorb as much sunlight.

Solar and Wind Power

I’m actively working to build solar and wind power for my home, so that I can reduce the amount of electricity I’m buying every month. By the time I retire, I expect to be able to produce enough to lower my monthly energy bill by at least $100 a month, if not more. I’m also switching over to solar hot water, which should reduce it even more.

Homesteading

While we’re really not turning our home totally into a homestead, we’re working on making it more and more like that. So far, we’ve got a sizeable vegetable garden going, as well as over a dozen fruit trees in our backyard.

As our ability improves, we hope to expand on that. We’re also putting in a chicken pen for eggs, a bee hive and a pond for raising fish. Every bite of food that we can grow ourselves, is one less that we have to buy.

Putting in a Well

I just finished building a well drill, which I hope to use to drill us a well. While our water bill isn’t a major part of our monthly expenses, a sizeable portion of it is used for watering our yard, trees and garden. Just being able to water those, without paying for the water will help us save. Oh, and by the way, I also use greywater capture for watering my trees.

Video first seen on Flyboytr.

There are many other ways in which you can reduce your monthly expense by doing things for yourself, rather than paying someone else to do them for you. I have a rather extensive workshop, where I repair my cars, build things we need, and do other things that most people have to pay someone to do. Everything you can do for yourself, is one less thing you have to pay others to do for you.

Redo Your Budget

If you’re going to survive the financial hardship of retirement, you really need to have a handle on what your expenses are going to be. Otherwise, you’re shooting blindly. You might just find that you hit the wrong target.

Now that the kids are out of the house, you should be able to live on a whole lot less than you used to. My wife and I found that our income seemed to go much farther, once the kids moved away. A lot of that is because we didn’t have to pay for things for them. But another part was that as mature adults, we didn’t have that many things we wanted. What we have is what we want. So we’re not constantly spending money on buying more stuff.

At the same time, you might find that you want to spend more of your income on things that you ignored before. My wife and I eat out much more, now that going out doesn’t mean paying $100 or more for the family.

We also find that our entertainment expenses are totally different, as they are not focused on the things the kids want to do. Actually, our entertainment expenses are quite low, even though we regularly do a number of activities.

Develop a Retirement Income Business

Just because your company says it’s time to retire, doesn’t mean that you have to agree with them. You have years of valuable knowledge and experience. All you need to do is find some way to put that to work.

Sadly, few companies today will hire older people when they can hire younger ones. That’s actually a rather simple business decision for most companies to make, since younger people will work for less than older ones will. But it leaves you and I without a job, unless we create one for ourselves. Fortunately, there are always opportunities to do just that.

If you haven’t embraced the Internet yet, it’s time to do so. Through it, you can connect with a wide range of people who are willing to pay you money. The best part is, you don’t have to leave home to do it; and if you want, you can even work in your pajamas.

Freelance in Your Professional Field

If you worked as a trained professional in any of a huge number of fields, there are still people who need your knowledge and experience. Maybe they can’t afford to hire you full-time, but there are many smaller companies that would love to hire you part-time or on a per-job basis, to help them out. Freelance opportunities are growing and there are a number of websites that provide a service, connecting companies that need freelancers to the freelancers themselves.

Start an eBay Business

One of the simplest ways to start a business today is to do so on eBay. Pick a category of products and start out small, buying a couple of cases at wholesale and shipping them out from your home. There are a large group of people who have built such a business into a full-time income.

Start a Blog or YouTube Channel

Blogs and YouTube videos both share something in common, the ability to share your knowledge and cash in on advertising dollars. From people who write about craft projects to women showing makeup tips, the income that you can derive from such an outlet is huge.

Develop Your Own Product

There is always room in the world for new products, especially truly innovative ones. Today, so many people are focusing on high-tech gadgets and apps for smartphones, that hardly anyone is making things to make everyday life easier. Yet there are still kitchen gadgets to be created, as well as things for a wide variety of tasks.

Turn Your Hobby Into a Business

If you like crafts, then turn that into a business. Etsy is a wonderful platform for selling quality handmade goods. I have a friend that is making handmade knives and selling the on Etsy. My dad’s retirement business was doing custom gunstock carving. As a sideline, he carved ostrich eggs, which he sold for $300 each.

Woodworking is a profitable hobby, too. Grab your tools and start practicing your skills!

There are literally hundreds of ideas that you can use to earn some additional income. If you start now, then by the time you reach retirement age, you could have a very good business built up; something to add to your Social Security and retirement income.

Remember, as you think about these ideas, that you don’t really need to earn as much income from your retirement business, as you earn now. You will have some retirement income that you will be able to count on.

So what you’re really doing is trying to come up with some means of supplementing that income. If you can do that, you’ll find retirement to be much more enjoyable.

This article has been written by Bill White for Survivopedia.

Thomas Graham | May 18, 2017

|

You said:

“My wife and I have used the windfalls we’ve received over the last several years to invest in gold and silver. While we haven’t been able to buy much at once, we have been able to increase our investment. We’re waiting for the day when the price of gold and silver rise enough that we can sell that off and use the proceeds to pay off our mortgage.”

But doesn’t the precious metal dealer make a profit off youevery time you buy or sell?

How much is this?